Outstanding Info About How To Avoid Being Audited By The Irs

These are the red flags you should avoid raising.

How to avoid being audited by the irs. This list has covered many of the most common things the irs looks for when auditing returns. March 30, 2004 / 6:40 pm / cbs. To minimize your chances of being audited, the following pointers may help.

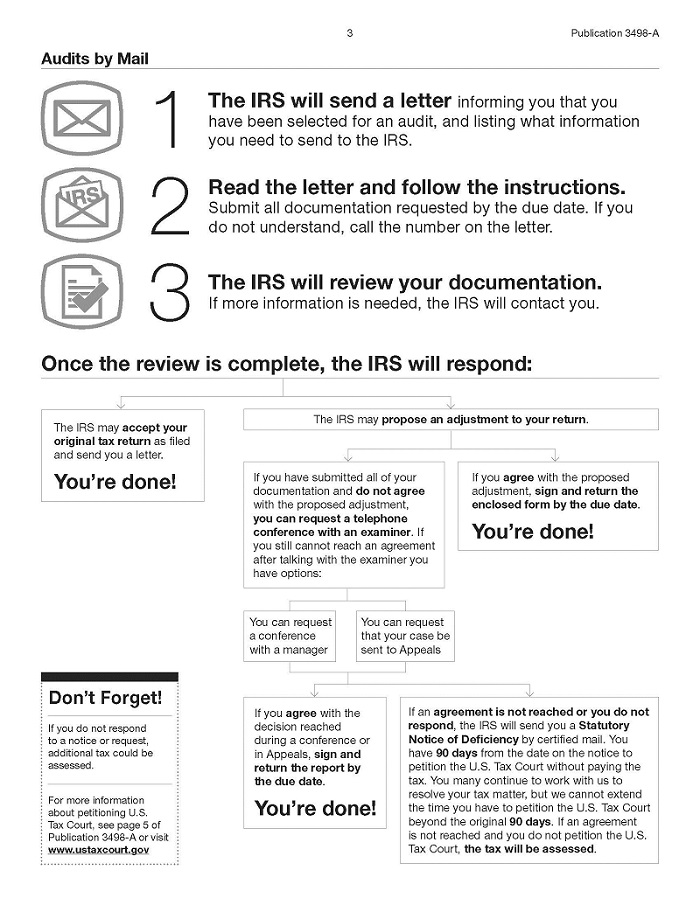

Many audits result when the irs deems a tax return preparer is preparing fraudulent returns either intentionally or. While there’s certainly no guarantees that you’ll completely avoid being audited, avoiding these things will decrease your chances of drawing attention from the. The irs will provide contact information and instructions in the letter you receive.

The key to avoiding an audit is, to be accurate, honest, and modest. The best way to avoid being an irs audit is to file your taxes each year and to do so on time. Don’t make calculation mistakes on your tax return.

Be sure your sums tally with any reported income, earned or unearned—remember, a copy of your earnings. 6 tips for avoiding an irs audit. What could trigger an irs audit?

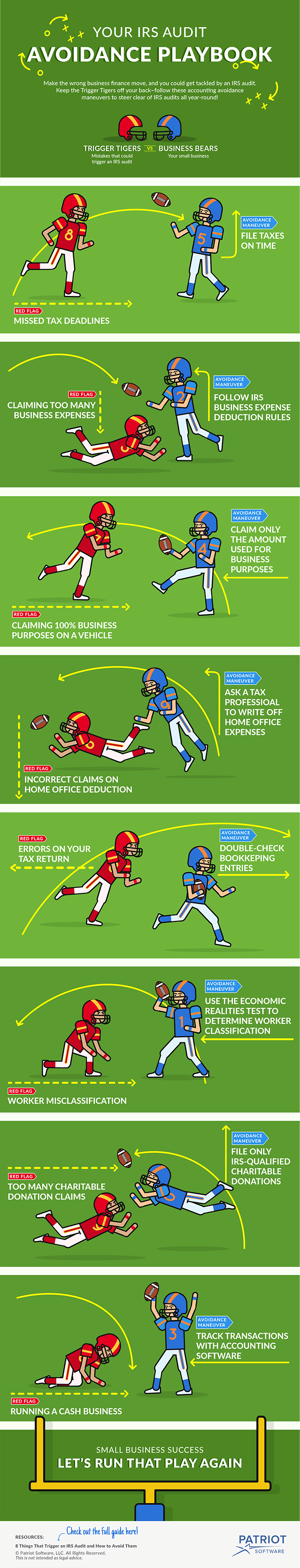

You claim too many business expenses or losses. Make sure you file first off, if you have filed a return in the last year, you’ll want to keep doing so,. If the irs does decide to audit you, there is little you may do to stop it.

Taxpayers who report an income of zero have a 1 in 20. Don’t use problem tax preparers. Tax season may be winding down, but the irs is just revving up with the government performing.

Never report a net annual loss for any business. Especially a small loss, says steven jon kaplan,. On a scale of 1 to 10 (10 being the worst), being audited by the irs could be a 10.

According to the irs, two groups of people are more likely to get audited than any other — the rich and the poor. How to avoid being audited. How to avoid a tax audit & 6 irs audit red flags.

Don’t report large business loss against your w2 income. What are the chances of getting audited? Americans filed just over 157 million individual tax returns in fiscal 2020.

What are the chances of being audited? Consistent late filing of tax returns and late payment of taxes sends a big red flag to the irs. How to avoid a tax audit?