Top Notch Tips About How To Apply For Commercial Loan

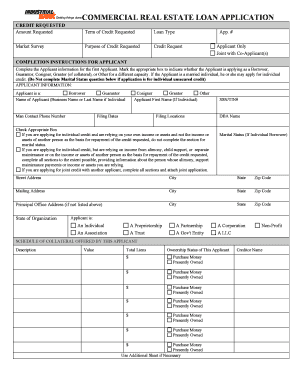

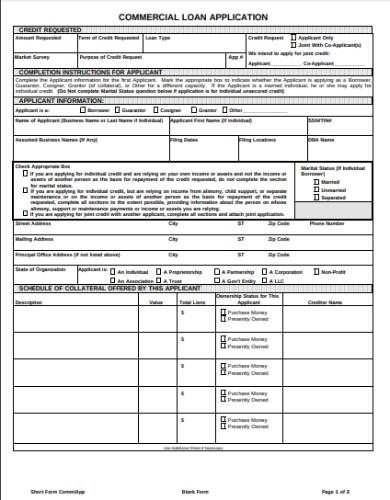

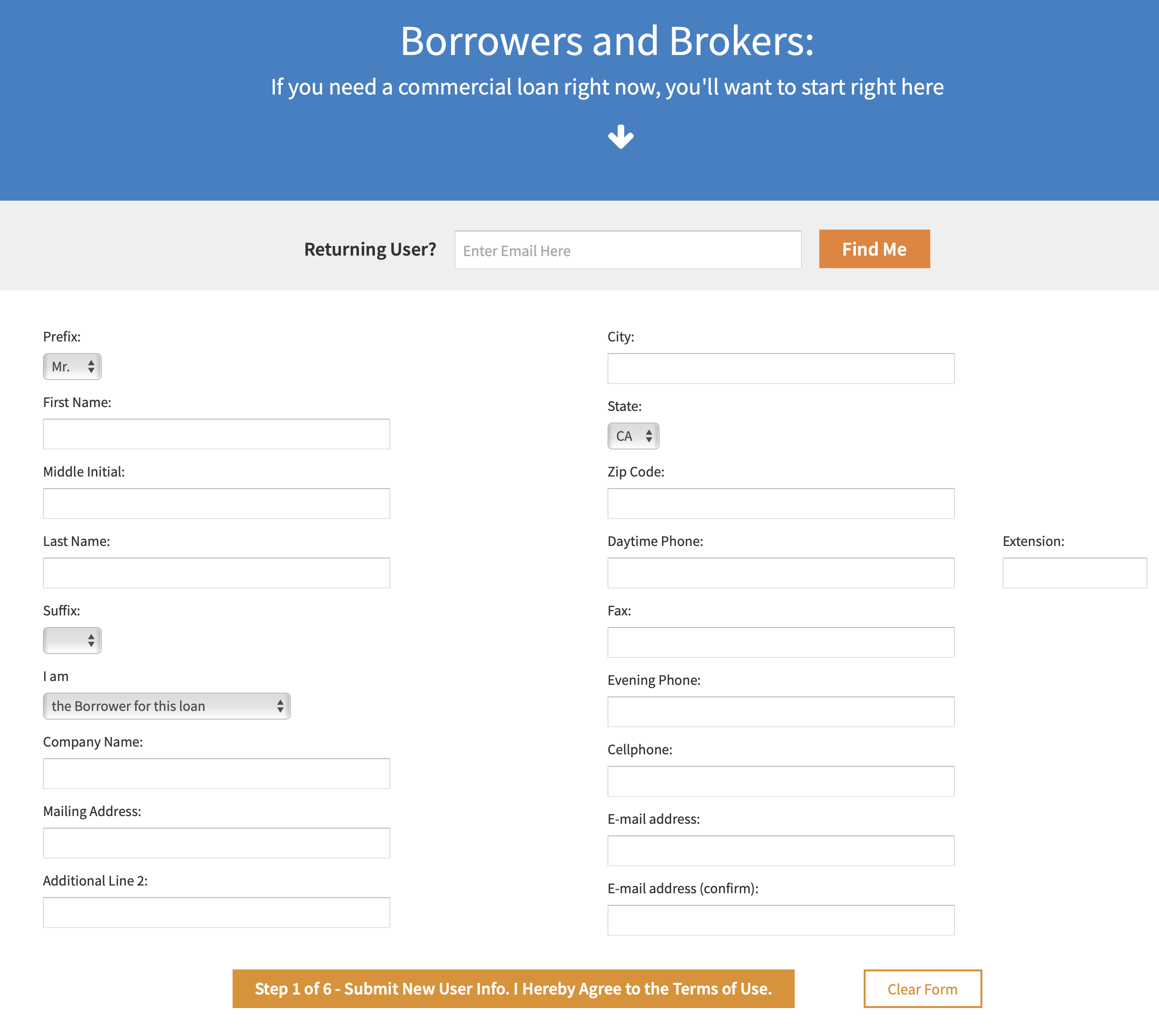

Enter the information requested below, and upload your support documents.

How to apply for commercial loan. A business line of credit (bloc) is a credit product, and rates are based on creditworthiness and will vary with the market based on the wall street journal prime rate. Take a look at your financial wellbeing, documentation, and consider applying for a loan through your local bank, the sba, or the multitude of online lenders—keeping in mind. Ad get a business loan from the top 7 online lenders.

Have an average net income of less than $5 million after federal income taxes for the two years preceding your application; For the most part, the benefit you'll get from having 10 to $20,000 worth of your. Over 90% of clients keep coming back for more funding, see why businesses grow with ucs

If you find a lower payment than ours, we'll beat it or pay you $250. Before you fire up your computer and apply for a business loan. Deciding why you need financing will help.

Miguel cardona said it wasn't ready in august. Compare up to 5 loans without a hard credit pull. Ad apply, if approved, extra funds can help keep your business moving forward.

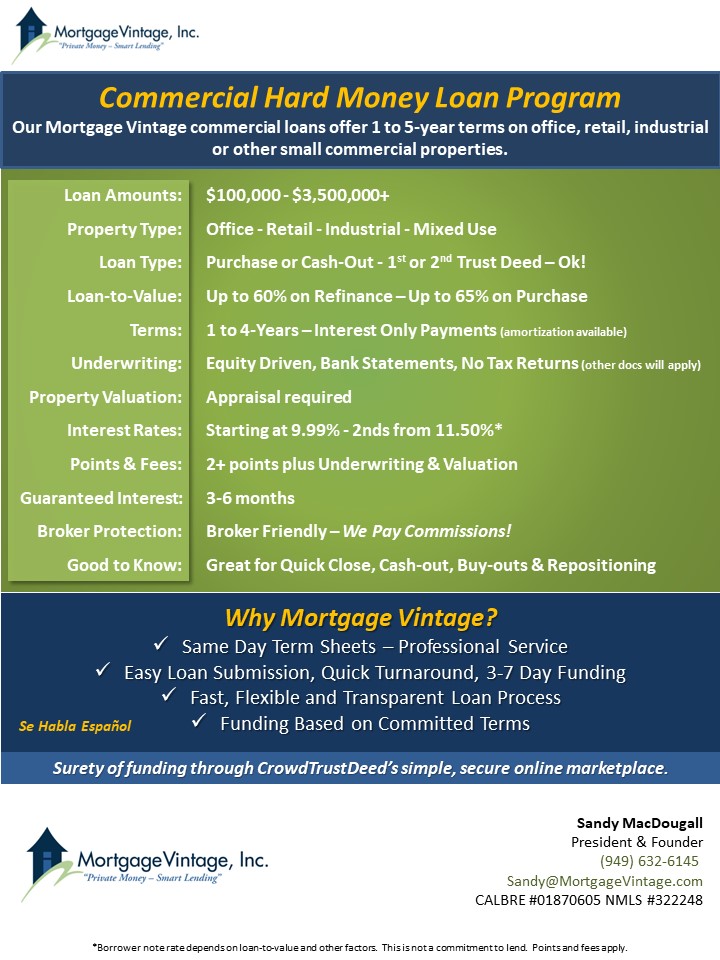

Now that you have determined what your business needs to qualify for a loan, the next step in learning how to apply for a business loan is to identify. How to get a business loan in 5 steps. Ad we can help you find the right commercial loan for your project, refinance or construction.

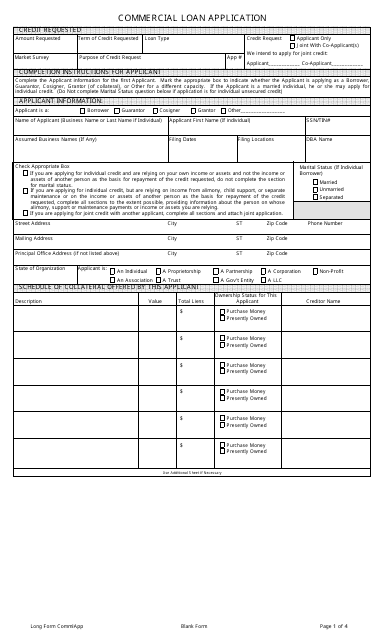

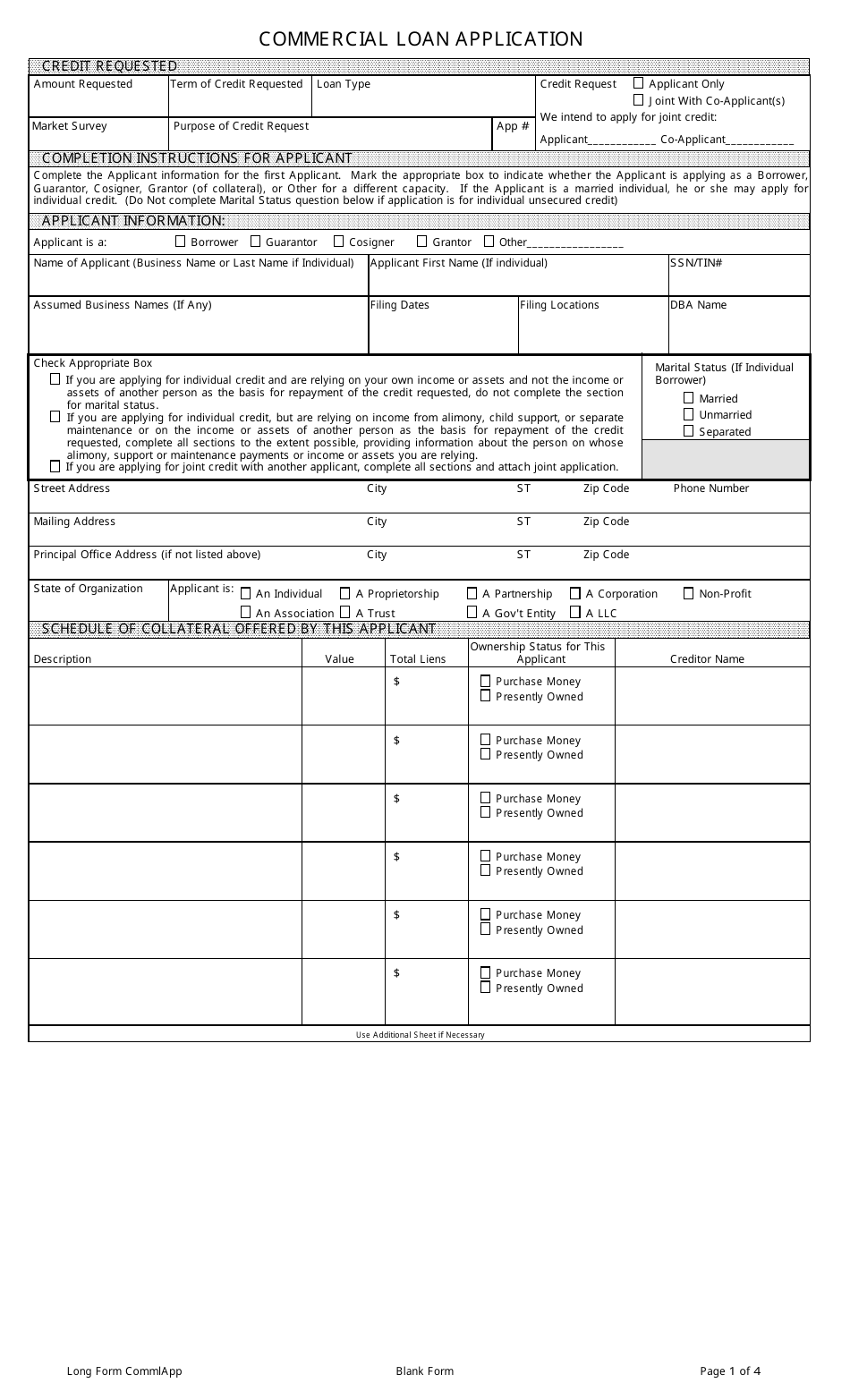

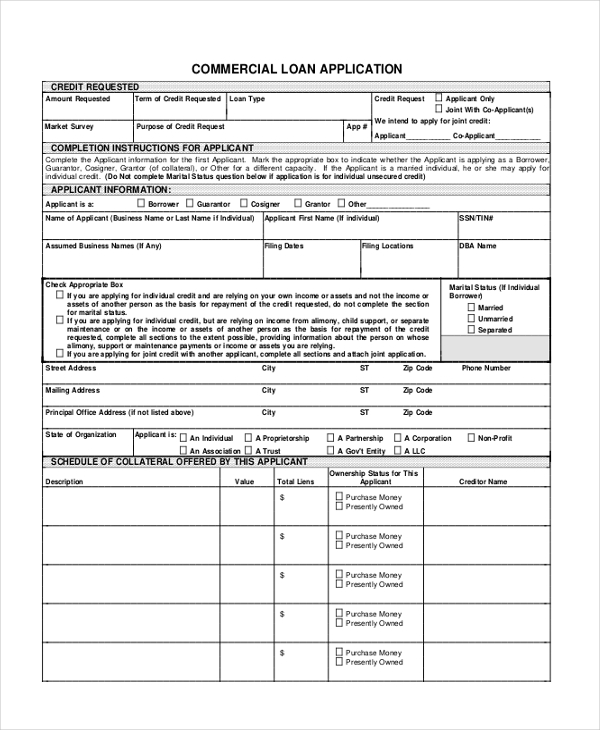

There are three ways to apply for a commercial loan through us: They can also be used to purchase land or develop, construct or renovate a. Figure out what type of business loan you want.

23 hours agoyou can get a refund without applying if your payments brought your loan balance below the maximum debt relief amount: The purpose of the business & industrial (b&i) guaranteed loan program is to improve, develop, or finance business, industry, and employment and improve. Apply, if approved, get access to flexible funding when you need it.

$10,000 for all borrowers, and $20,000 for pell grant. At the moment, the sba 7 loan program has a variable interest rate of 7.75% to 10.25%, depending on the loan amount and repayment period. There’s more than one kind of small business loan.

Helped +225,000 small businesses since 2007. It’s still a very competitive rate,. Ad compare 2022’s top online lenders.

The undersigned hereby certifies that the information contained in this application and related materials is true and correct. 10 best business loans of 2022. You can apply for a business advantage auto loan online;

![Commercial Loan Application Checklist [Infographic] - Altabank](https://www.altabank.com/assets/content/owpLHyD8/Commercial-Loan-Checklist-Infographic_2000x5000-819x2048.png)