Peerless Info About How To Increase Earnings Per Share

So, a company can increase its eps by increasing its net profit.

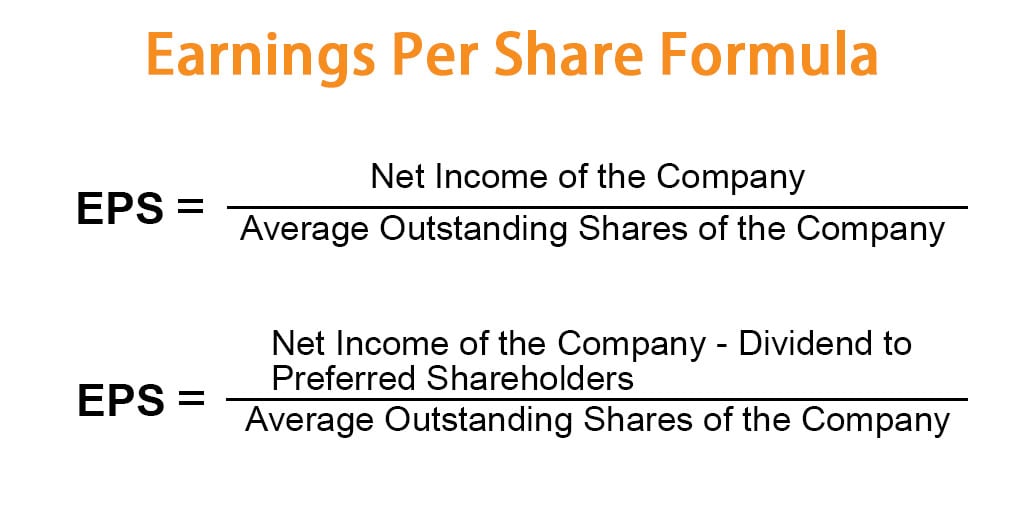

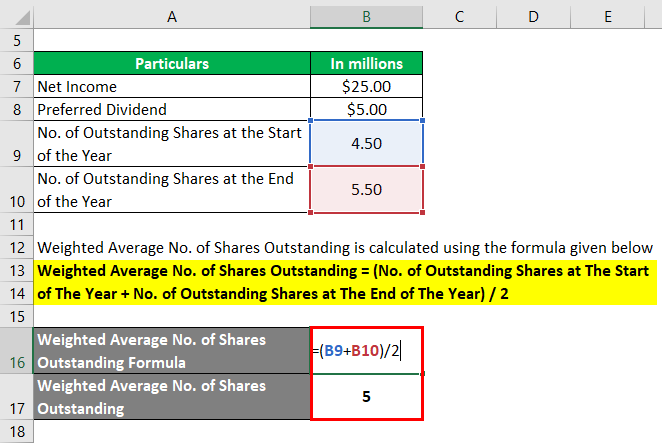

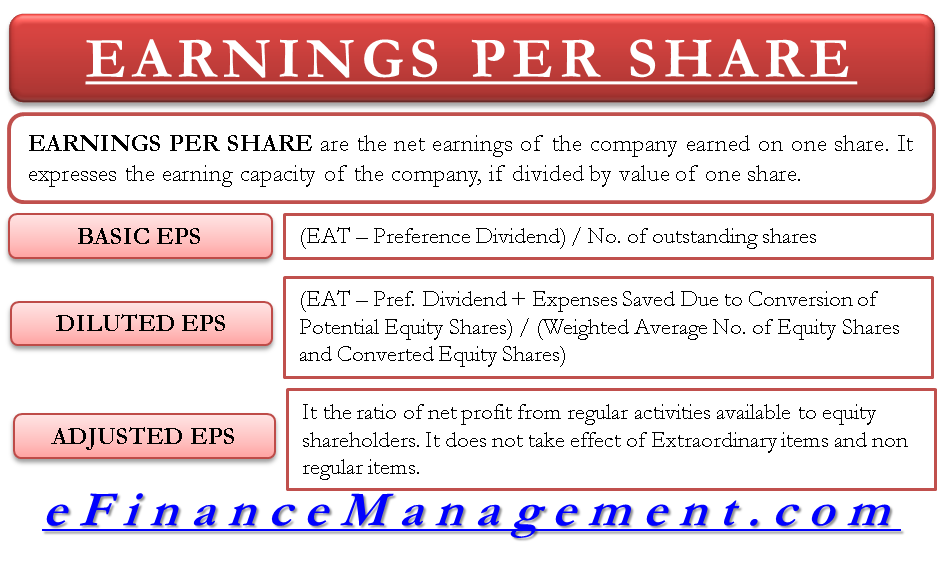

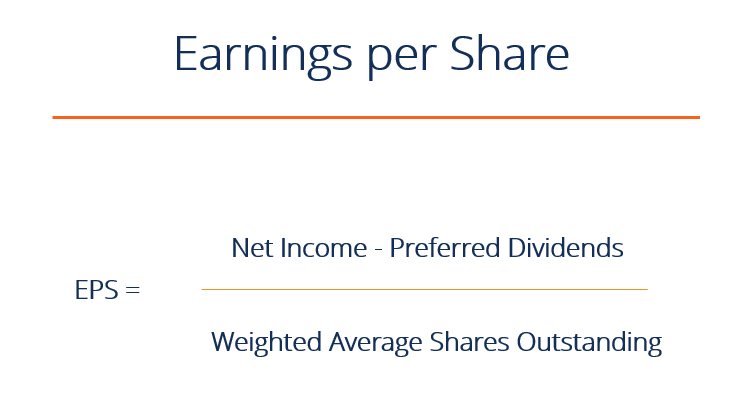

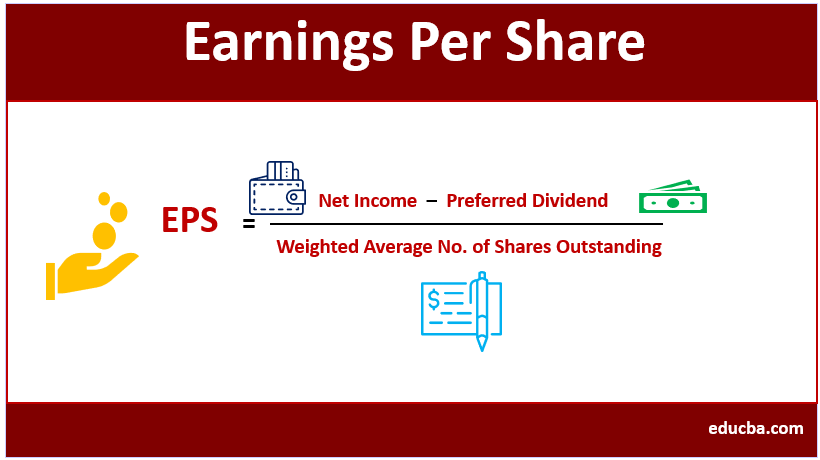

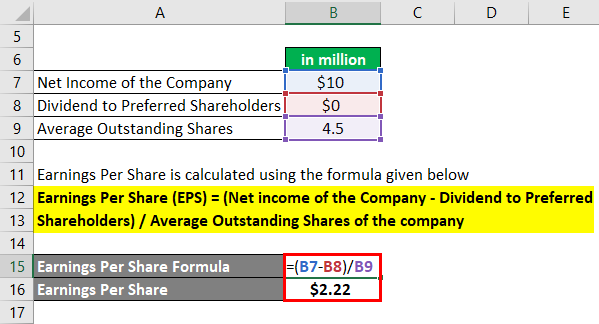

How to increase earnings per share. By raising the net income of the company net income is calculated after. Earnings per share increases when the total number of outstanding share decreases in case of buyback. One way to boost eps is to pursue actions that will raise net income (the numerator in the formula for calculating eps).

There are two primary reasons for increases in a company’s dividend per share payout. The first is simply an increase in the company's net profits out of which dividends. For example, assume company fonem in the first

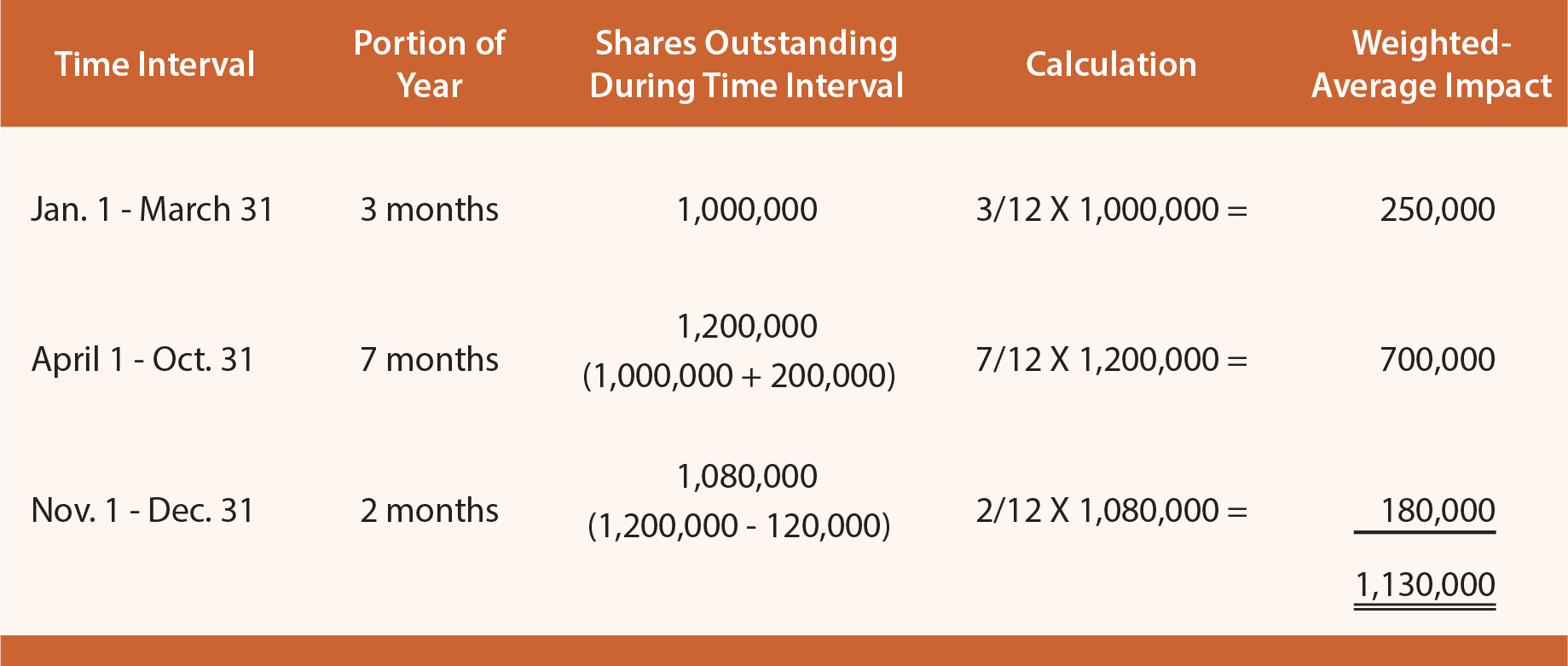

When a stock splits, the total number of shares increases. By doing so, a company doesn't have to improve its net income. This affects the eps because it affects the total number of shares.

How to improve earnings per share? Stock splits and earnings per share. Using a company's net income or earnings for.

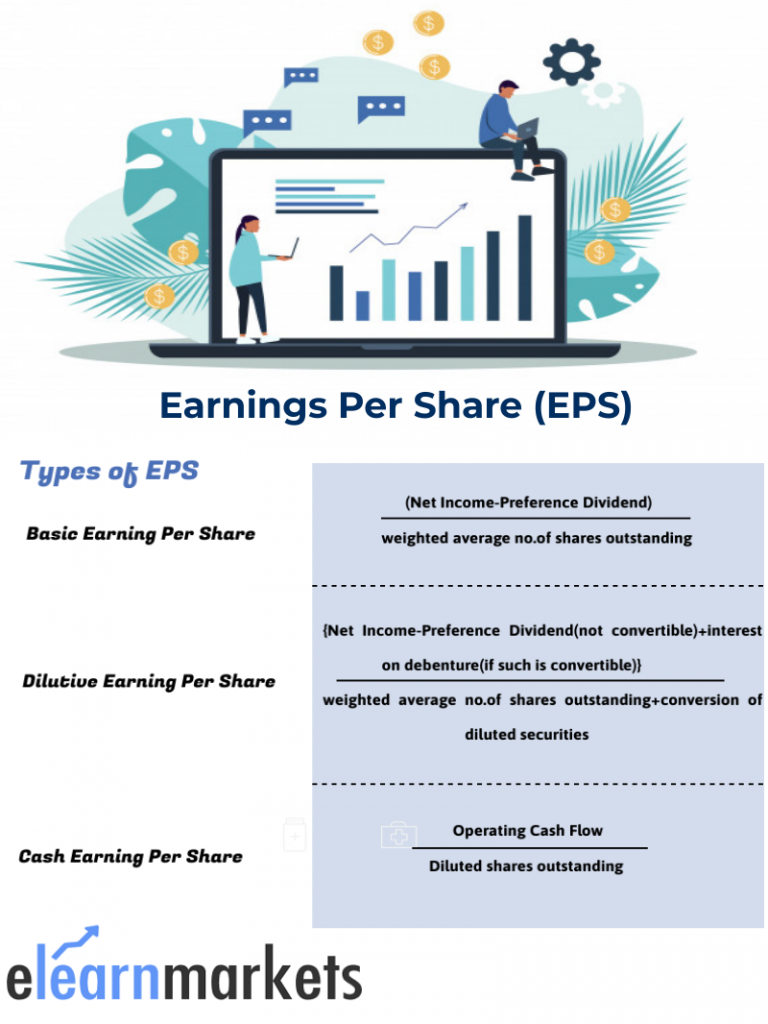

See the answer see the answer done loading. There are 2 ways, either you earn more by increasing. Increase in earnings per share means, for any plan year, the percentage increase in earnings per share ( including any earnings decrease as a minus amount) for said plan year over the.

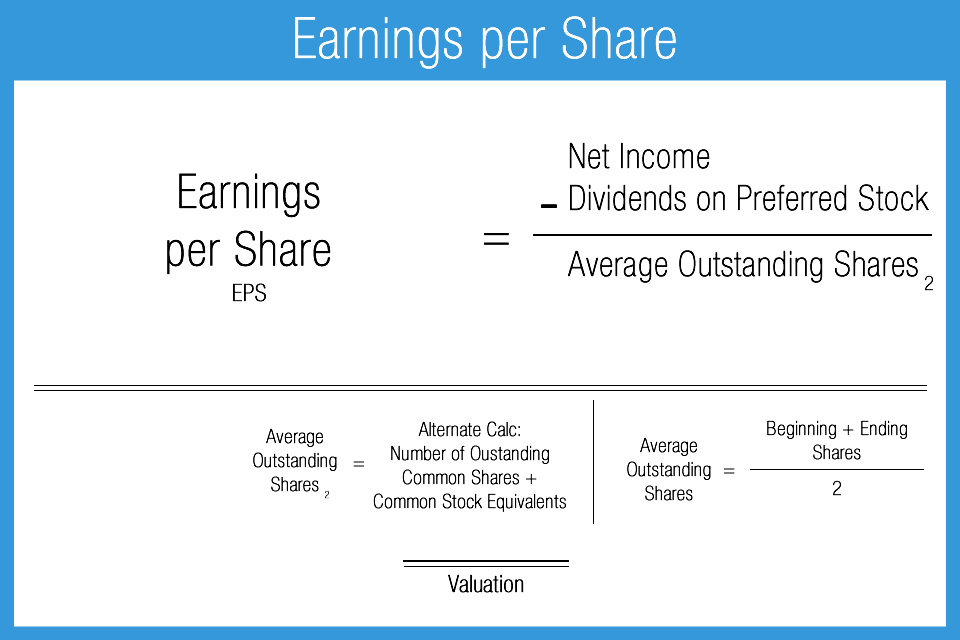

Revenue per share is usually the part of a company's profit given to each outstanding share of typical stock. A second means of boosting eps is to repurchase shares of stock, which. Eps ( earnings per share ) increases when earnings (net profit) increases, or when the quantity of shares is reduced.

For example, a company might increase its dividend. Eps ( earnings per share ) increases when earnings (net profit) increases, or when the quantity of shares is reduced. Determine the company's net income from the previous year.

So, a company can increase. To increase your shareholder value you must: When expenses decreases and company is able to cut the cost.

A higher eps means a company is profitable enough to pay out more money to its shareholders. Why would earnings per share increase? Divide the net income by the number of shares outstanding.

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-03-4a893d6e5ada40ecaa56ea3f7fc0db4a.jpg)

/terms-e-eps.asp-ADD-V2-fa5ba53d533849729ef1ca4974379b13.png)

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)