Unique Tips About How To Apply For Reverse Mortgage

At least 55 years old;

How to apply for reverse mortgage. True consumer advocacy for seniors and retirees. On your reverse mortgage application, you must include all the individuals listed on your home’s title. Get real answers to hecm loan questions.

Reverse mortgages don’t have income or credit score requirements. Ad find an fha approved reverse mortgage lender here. To be eligible for a reverse mortgage, you must be:

You must either own your home outright or. Get a free information kit. You have to meet the following fha requirements to get a hecm:

However, the longest part of the reverse. See how much you could qualify for step 2: How much money can i get with a reverse mortgage loan, and what are my payment options?

And, if you don’t pay. A reverse mortgage allows you to borrow money using the equity in your home as security. Reverse mortgages allow seniors age 62 and older to borrow against the equity of their primary home, with the lender making the payments instead of the borrower.

Can anyone take out a reverse mortgage loan? A lender cannot begin processing a reverse mortgage loan application until. Requirements for applying for a reverse mortgage if you’re considering applying for a reverse mortgage, there are some basic requirements you need to meet.

Borrowers can also apply for federally insured reverse home mortgages which are commonly known as home equity conversion mortgages or hecms. Do i have to use an estate planning service or pay to find a reverse mortgage? Aag® is america's #1 reverse mortgage provider & has educated over 1 million retirees.

Ad home equity a valuable contributor to retirement — especially during this uncertain times. Learn more & see if you qualify. Table of contents step 1 (optional):

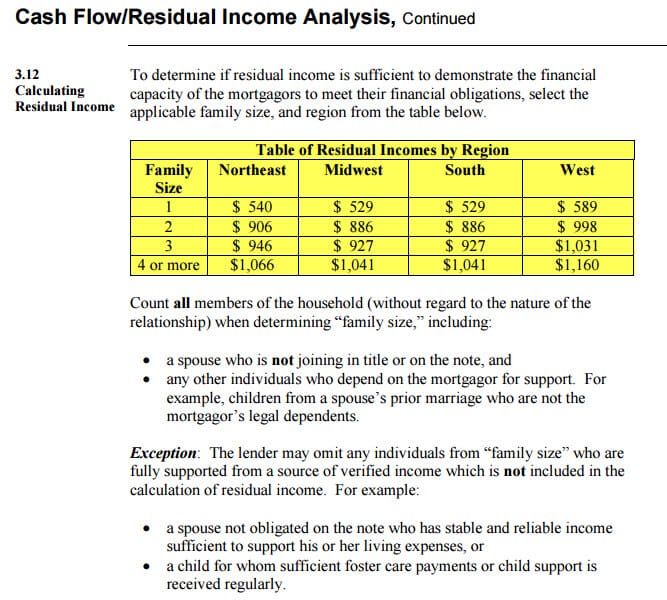

Ad compare the best reverse mortgage lenders. A hecm loan is a hud approved. Wants to apply for a reverse mortgage but doesn’t know if she qualifies because of her limited income.

Receive a commitment step 4: Ad if you’re 62 or older, a reverse mortgage loan may be right for you. It can be paid to you in one lump sum, as a regular monthly income, or at the times and.

:max_bytes(150000):strip_icc()/dotdash-reverse-mortgage-or-home-equity-loan-v3-eb9ddc756b1d47adba885c60bf2f854c.jpg)